We all like to start the New Year with a fresh mindset and, for some, a few resolutions – but it can also feel a daunting time after Christmas when it comes to your finances.

Whether you’ve got debts to pay off or want to begin putting any spare cash aside each month, our partners at PayPlan – one of the UK’s largest free debt advice providers – have now shared some tips to help you combat the cost of living increases and get you on the road to your financial goal in 2023.

You can read them here:

A New Year’s resolution can often feel like a daunting process and something that you’ll stick to for a few weeks before losing motivation – but it doesn’t have to be that way.

When it comes to fixing your finances or making a savings goal, creating a budget/plan is exactly what you need.

PayPlan’s here to ensure you get your plan in action today and they’ve outlined different ways to help you stick to your target this year.

Choose your goal and set a budget

So, if your resolution this year is to be debt-free or save a certain amount per month, you’re going to need to set a budget – and PayPlan details exactly how to do that on their website.

PayPlan’s November Cost-of-Living Impact Survey found that just over one in three (36%) are dipping into their overdraft more often, while over half (57%) are missing payments. Creating a budget with all your income and expenses is the easiest way to get in control of your finances. If you can form a habit and make this something you do every time you get paid, you’ll be able to stay in control of your finances all year round.

Assess your outgoings

When setting out your budget, you’ll start to identify exactly where your money is going. This is a great opportunity to assess your outgoings and identify if certain areas of spending can be made cheaper.

From switching utility providers to cancelling unused subscriptions, you can save more than you’d think per month, which will add up over a year. Have you stopped watching shows on Disney+, Netflix or Amazon Prime? Do you still use Spotify, YouTube Premium or Apple Music? Are you still signed up for any monthly clothing, magazine, news or gift sets that you no longer use or need? If so, these all act as potential ways of saving money each month. You could also look at sharing subscriptions with your partner or friends with many deals offering multiple device rates which, when split, can work out to be cheaper.

Form good habits

Creating new habits will help you stick to your goal and, in the long term, will become second nature to you. There are a number of good habits when it comes to saving money. This could be as simple as cutting back on luxury items each month, planning your shopping before you hit the supermarkets, so you don’t overspend, or putting money into a pot or account as soon as you get paid so it’s out of sight and out of mind.

New habits that are often kick-started in the new year include monthly campaigns like Dry January, and Veganuary, but this can continue throughout the year and can lead to cutting down things such as smoking, drinking and meat consumption, which can help keep your shopping costs down and have a positive impact on your health too!

Plan ahead

You’re already in the mindset of planning ahead after assessing your budget, so why stop there? This year, if you attend any birthdays, social events or have a holiday lined up, make sure you get the most out of your money by planning ahead and taking advantage of cheaper travel, accommodation and deals.

Planning for events that you know are going to cost you money is time well spent. By having money put aside for presents, you’re less likely to need to use credit to cover the cost and you’ll have a better handle on your spending limits – and therefore, reduce your spending!

Aside from putting money into a savings pot, other ways to save for occasions are:

- Set spending limits on gifts for people

- Don’t spend for the sake of it

- Buy Christmas cards and wrapping in January – it’s when they’re the cheapest!

- If someone has asked for an expensive gift, ask friends or family if they’d like to club together and purchase it as a joint gift.

Maximise your income

You can also explore ways of maximising your income this year – whether that be through selling your old clothes, CDs, DVDs, phones/tablets or even furniture. If you’re thinking of replacing your items, see if you can make your decisions cost-efficient by looking at the value of your old items and seeing if you could even make money. There are a number of free ways to sell your items, such as Facebook Marketplace, CEX, Music Magpie and WeBuyBooks.

You could also explore mobile apps that help you save money, provide you with cashback or offer rewards like reduced airtime costs or money for walking/taking photos. Websites such as TopCashBack, Airtime Rewards, Foap and SweatCoin are ways of potentially supporting your income/cutting your outgoings.

It’s also crucial to ensure you’re taking advantage of all of the schemes and benefits available to you, and PayPlan offers a benefit check calculator on their website. The calculator is free to use, and the details you provide are anonymous. Before you start, make sure you have information about your savings, income, pensions and existing benefits (for you and your partner).

If you’re worried about your finances or struggling to keep up with debt repayments, remember PayPlan’s there to help. You can access their help in a variety of ways including live chat via the website www.payplan.com/the-fire-fighters-charity or by freephone on 0800 072 1206.

We also have a range of resources available to you to support you this winter. Find out more here:

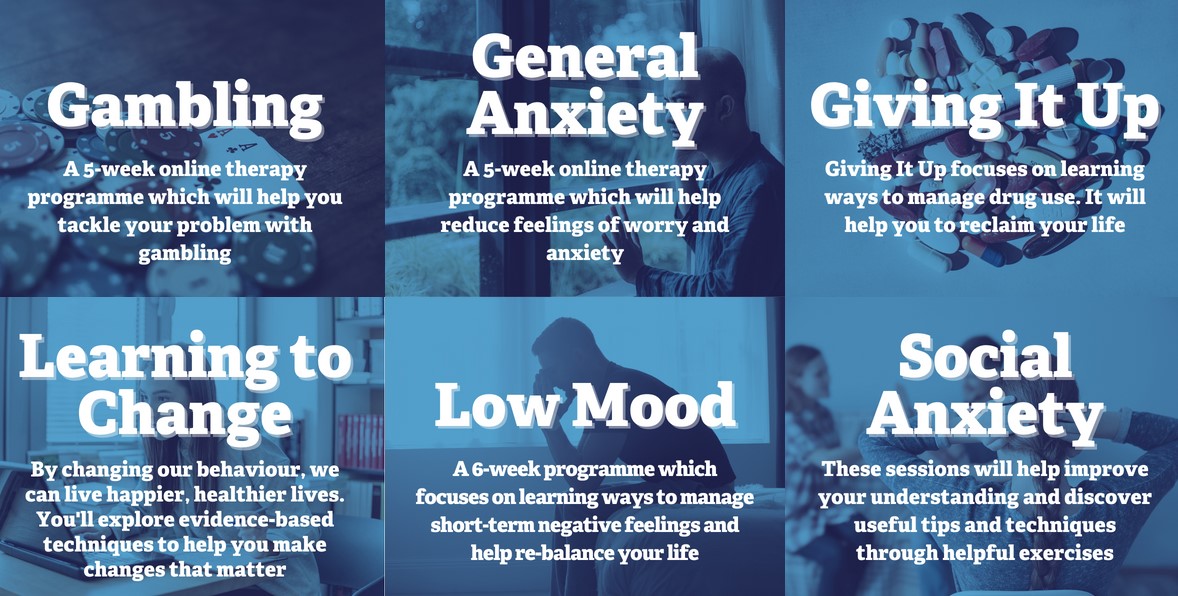

Try our full online courses on MyFFC

We have a great range of six-week online courses available through MyFFC, just log in and register for whichever course interests you. Available courses include: Learning to change; Low mood; General anxiety and Gambling.